Working Papers

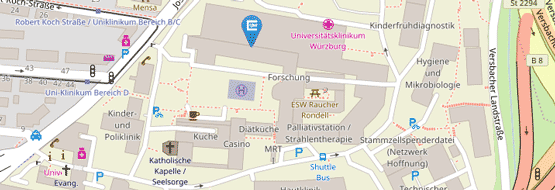

Working Paper Nr. 5 – Understanding Migrants’ Willingness to Pay Income Taxes: A fiscal citizenship perspective

Johnathan Farrar, Oliver James, Kim-Lee Tuxhorn & Josef Wunderlich | November 2023

We investigate why immigrants are willing to be tax compliant and how their willingness to be tax compliant may differ from non-immigrants. To undertake this exploratory investigation, we conduct a survey (n=4,670) of adult taxpayers in Canada, Germany, and the United Kingdom. Just over 10% of this sample (n=492) is immigrants. To frame this study, we use political science literature on citizenship to develop and test a model of fiscal citizenship. Our model consists of four factors (voice, contribution, social exclusion, and tax compliance). The voice and contribution factors have subfactors. Accordingly, we investigate the association of each factor and subfactor on tax compliance. Results indicate that immigrants are willing to be tax compliant if they have a voice in the tax policy process in the form of a vote but not in a less formal way, and if there are few restrictions on who receives government benefits. Moreover, results indicate that non-immigrants are unwilling to be tax compliant if they have a voice (vote or otherwise) in the tax policy process. And, results indicate no significant association between moral obligation and tax compliance for immigrants, whereas this association is positive and significant for non-immigrants. Our study has implications for governments which are challenged with anti-immigrant sentiments, as our results suggest circumstances in which immigrants are willing to pay income taxes.

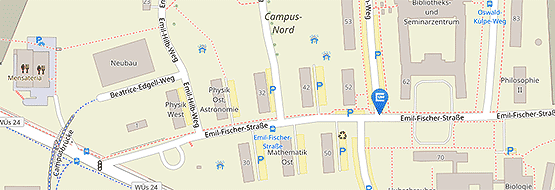

Working Paper Nr. 4 – Multidimensional Tax Compliance Attitude

Christoffer Bruns, Martin Fochmann, Peter N.C. Mohr & Benno Torgler | Oktober 2023

Citizen tax compliance significantly dictates governmental fiscal capacities. Recognizing this, understanding the determinants of tax compliance remains paramount. While existing literature frequently isolates and tests individual determinants such as audit likelihood, penalty structures, tax morale, and perceived fairness, an integrative, bottom-up approach addressing the spectrum of tax compliance attitudes has largely been overlooked. Addressing this gap, our study constructs a multidimensional Tax Compliance Attitude Inventory (TCAI) by harmonizing real taxpayer responses with established theoretical underpinnings. Through factor analysis, we delineate four pivotal factors: (i) morale, (ii) monetary benefit, (iii) deterrence, and (iv) authority. Notably, morale and deterrence emerge as consistent influencers of tax compliance. Embracing this multidimensionality, our cluster analysis demarcates two distinct taxpayer personas: (a) moralists and (b) rationalists. Our findings underscore that moralists consistently exhibit higher tax compliance than their rationalist counterparts. We further present a streamlined classification algorithm to operationalize the TCAI in new datasets, minimizing item count. This work serves as a seminal contribution, offering both academia and tax authorities a robust, quantitative tool to gauge tax compliance attitudes.

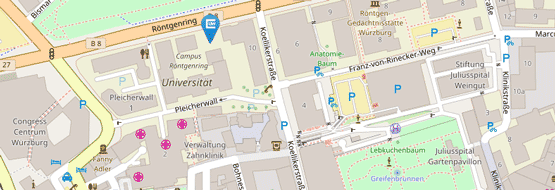

Diskussionspapier Nr. 3 – Measuring an Absence of Fiscal Citizenship: Reflections on the tax gap

Lotta Bjorklund Larsen & Lynne Oats | Juni 2023

The tax gap is an increasingly common mechanism for assessing the mismatch between tax that theoretically should be collected, and tax that is actually collected. There are many countries that attempt to estimate what can be conceived of as a “revenue loss” and is in effect an absence of fiscal citizenship. The work of quantifying the tax gap has assumed almost a mythical status, presumed to be an accurate reflection of a real phenomenon. Simple in theory, full of caveats in practice, this is a number that causes quite a stir when published: “Imagine the good policies that could be implemented if all due tax was collected”! Politicians and public administrators steer compliance policies by reference to the tax gap, tax administrations see a shrinking tax gap as a sign of success. Media and stakeholders make all sorts of comparisons based on this fickle number.

This paper revisits the work with recent quantifications and calculations of the tax gap in Sweden and the United Kingdom. By using the concepts of imaginaries, we consider the political framing of these tax gap calculations, where the appropriation of the gap “number” by the commentariat has important implications for the management of fiscal citizenship.

Diskussionspapier Nr. 2 – Conceptualizing Fiscal Citizenship

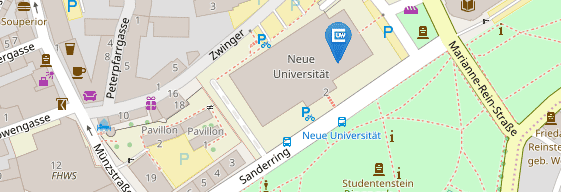

Charlotte Schmidt, Eva Matthaei & Hans-Joachim Lauth | April 2023

Although the concepts of willingness to pay taxes and citizenship are interconnected through the social contract and are crucial for maintaining social cohesion in any civil state, researchers have primarily studied these topics independently of each other. This paper aims to synthesize both research fields. Relying on social contract theory, we develop a concept tree that captures the resulting multidimensional concept of fiscal citizenship. Fiscal citizenship comprises behaviors, attitudes, and identifications of citizens towards the state and fellow citizens that arise through the payment of taxes and are based on the idea of reciprocity. At the microlevel fiscal citizenship is to be considered a gradual individual trait, aggregated at the country-level it represents the overall fiscal and civic climate within a state and may serve as an indicator for social cohesion. The concept encourages new research questions and new perspectives on existing ones. It may serve as a tool to map and connect previous ideas and findings, derive innovative hypotheses and gain new insights. Furthermore, the concept enables the operationalization and empirical measurement of fiscal citizenship with microanalytical data. This allows for the first comprehensive analysis of the interconnection between taxes and citizenship and its meaning for social cohesion in future research.

Diskussionspapier Nr. 1 – Tax Culture/s

Lotta Björklund Larsen | Januar 2023

Tax authorities and finance ministries try in many ways to ensure that taxes are correctly reported and paid. Concepts such as tax gap, tax morale, tax compliance drawing in turn on taxpayers’ attitudes, social norms, values and willingness are applied. Tax systems are assessed in terms of fairness, equitability and justice. Much quantitative research has gone into investigating the various factors making up these concepts as well as the relation between these factors.

In the search for explanations, the notion of tax culture is sometimes mentioned (Nerré 2001, 2008; OECD 2015 [2021]; Mumford 2002; Livingston 2020). The aim of this working paper is to problematize tax culture as it is often used in a quite simplistic way. This is important for several reasons. First, unexplained, culture seems to be a collector of what cannot be explained by other concepts. “It is cultural” makes the concept a container for the unexplainable and irrational. Second, defining culture came out of an ambition to understand why people in the world were so different – not by looks but by describing beliefs, behaviour, family relationships and how they integrate these into their modes of survival and living. Culture applied this way can be used to explain the qualitative aspects of taxation. Third, culture has often been equalized with national cultures, but as I will illustrate has the simplistic correlation of culture = nation some unfortunate implications when relating to existing tax scholarship.

There are probably many, many more reasons but this working paper aims to add to the growing literature on tax culture. I build on earlier attempts using culture within tax scholarship. My contribution here is to draw more in-depth on anthropological concepts of culture to think about how we can understand tax culture and how to research it in the contemporary global and digital world.